Breaking boundaries in fintech infrastructure and customer app development: unveiling the Integrated Finance and Finxone partnership

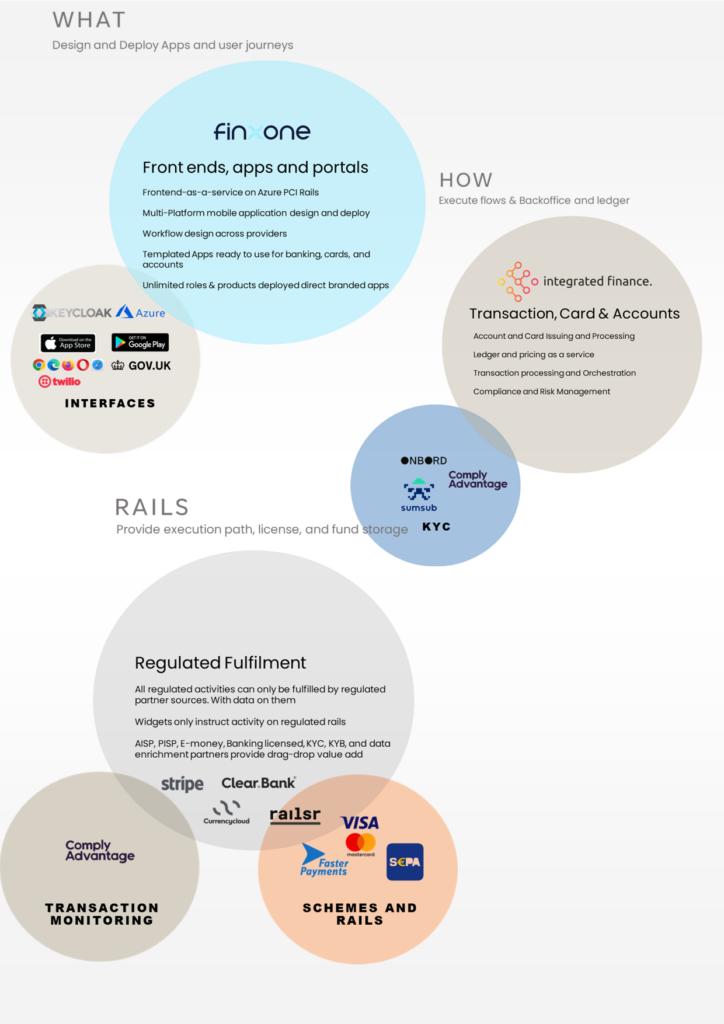

In the ever-evolving landscape of fintech, innovation is driven by strategic partnerships that leverage each other’s strengths. A perfect example of this synergy is the collaboration between Integrated Finance and Finxone. Integrated Finance, a UK-based API-first fintech infrastructure company, provides a suite of core banking PaaS and pay-as-you-grow pre-built banking connections, while Finxone, a leader in no-code fintech application development, empowers businesses to build differentiated banking products.

The Integrated Finance infrastructure suite of solutions include account / card issuing and transaction processing, cross-border and local payment rails, transaction orchestration, and compliance and risk. Businesses can pick and choose the solutions that best fit their needs while also ensuring each solution is standardised and interoperable for a fully redundant fintech stack.

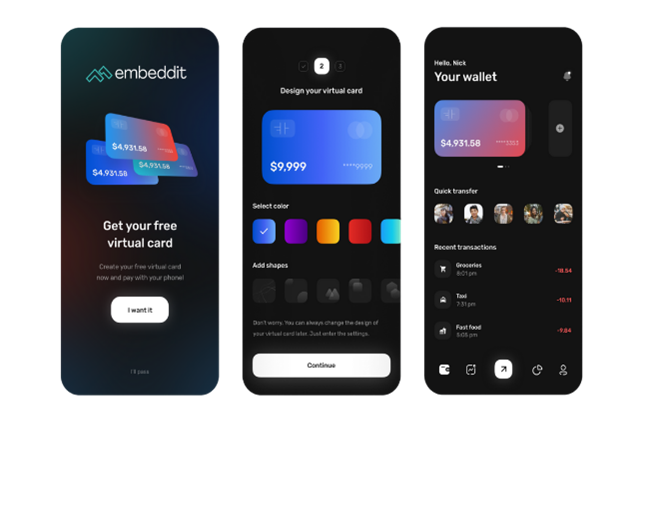

Imagine a scenario where building a fintech customer application involves simply dragging and dropping pre-designed widgets that are integrated with Integrated Finance’s core banking APIs . This synergy allows businesses to skip the intricate coding process, enabling them to focus on crafting unique and value-driven experiences for their users. The result is an agile, cost-effective, and highly customizable development process.

One of the most significant advantages of this partnership is to enable businesses to effortlessly tap into a comprehensive set of financial services without the need for additional integration efforts. The pre-integrated widgets are designed to seamlessly fit within the application’s design, ensuring a consistent user experience while saving precious time and resources.

Furthermore, this collaboration enables businesses to innovate rapidly. By utilizing Finxone’s drag-and-drop design philosophy and Integrated Finance’s fintech infrastructure, companies can achieve scalable unit economics by reducing development costs, and allowing them to unlock revenue streams as they grow their customer base.

Ultimately, the partnership enables fintech businesses to bring their vision to market faster than ever before.

More articles about our partnership with Integrated Finance

Integrated Finance and Finxone aim to revolutionize the fintech landscape by providing a unified and streamlined platform for financial innovation.

Our partnership is underpinned by an unwavering commitment to protecting your business.

Here's the magic: integrated Finance’s modules can be consumed via Finxone.

Build apps in your sandbox, and issue to a limited number of users to check out your ideas. No more clickables, real code, that really works.

Imagine a scenario where building a fintech application involves simply dragging and dropping pre-designed widgets that are directly linked to Integrated Finance's APIs.

Build what you need, when you need, how you need it. Visual tools, make for powerful experiences. No need to pay anyone to update your app.