From idea to prototype: here's how Integrated Finance and Finxone can streamline the development journey.

Turning a brilliant fintech idea into a tangible prototype is a journey often fraught with challenges, delays, and high costs. However, the partnership between Integrated Finance and Finxone is changing the narrative. By combining Integrated Finance’s sandbox and Finxone’s innovative no-code application development platform, businesses can now transform their fintech concepts into fully functional prototypes in a matter of weeks, not months.

The foundation of this revolutionary partnership lies in the concept of sandbox environments. Integrated Finance offers a “sandbox” state for their APIs – a safe space for clients to experiment with their financial building blocks .. Similarly, Finxone provides its own sandbox environment that enables new and potential customers to build test applications using drag-and-drop design principles. This collaboration amplifies the benefits of sandboxing, accelerating the path from idea to prototype and fundamentally changing the way fintech innovation takes shape.

Access to APIs: Integrated Finance’s sandbox can be readily available to Finxone’s customers. This access allows businesses to bring their fintech to life, eliminating the usual setup and integration hurdles.

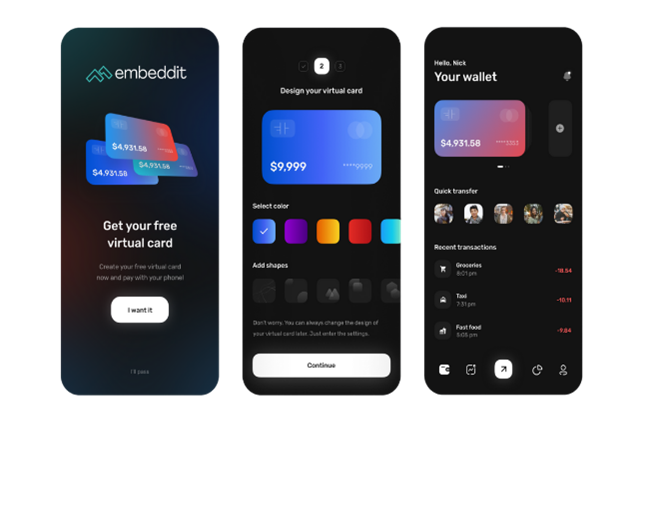

No-Code Prototyping: Finxone’s no-code development platform empowers businesses to design and build prototypes without the need for coding skills. The drag-and-drop interface makes it easy to assemble different elements and functionalities, creating a tangible prototype that captures the essence of the fintech concept.

Cost-Efficiency: Traditional prototype development can be expensive and time-consuming. By leveraging Integrated Finance’s sandbox and Finxone’s no-code tools, businesses can save on development costs and reduce time-to-market significantly.

Risk Mitigation: The sandbox environments allow businesses to explore ideas and concepts without the risk of non-compliance. This risk mitigation is crucial, especially when dealing with financial data and services.

Easier Funding Rounds: A well-developed prototype is a powerful tool for fundraising. With a functional MVP in hand, businesses can confidently approach investors, showcasing a tangible representation of their fintech innovation.

Proof of Concept: With the ability to swiftly build prototypes, businesses can create tangible proof of concept applications. These prototypes can be used to demonstrate the viability of the idea to potential investors, stakeholders, and even regulatory bodies.

MVP Development: The partnership facilitates the creation of Minimum Viable Products (MVPs). These functional prototypes provide a working model of the final product, allowing businesses to gather valuable insights and validate their concept with real users.

By providing businesses with the tools to rapidly move from idea to prototype, the joint collaboration empowers entrepreneurs, startups, and established companies alike to explore new avenues of fintech innovation. As the fintech landscape continues to evolve, partnerships that foster innovation and efficiency become increasingly vital. Integrated Finance and Finxone have not only recognized this need but have also acted upon it. Together, they are rewriting the playbook for fintech prototyping, turning visionary ideas into reality at a pace that was once unimaginable.

Scalable Prototyping

Finxone provides access for up to 20 users of your business to create up to 20 individual apps. Businesses can then test their prototype app by up to 100 test users in the sandbox environment. This scalable prototyping capability enables comprehensive user testing and feedback gathering, facilitating iterative improvements and ensuring that the final app meets the needs and expectations of the target audience.

More articles about our partnership with Integrated Finance

Integrated Finance and Finxone aim to revolutionize the fintech landscape by providing a unified and streamlined platform for financial innovation.

Our partnership is underpinned by an unwavering commitment to protecting your business.

Here's the magic: integrated Finance’s modules can be consumed via Finxone.

Build apps in your sandbox, and issue to a limited number of users to check out your ideas. No more clickables, real code, that really works.

Imagine a scenario where building a fintech application involves simply dragging and dropping pre-designed widgets that are directly linked to Integrated Finance's APIs.

Build what you need, when you need, how you need it. Visual tools, make for powerful experiences. No need to pay anyone to update your app.