Finxone is revolutionising the way businesses connect to their chosen

Banking-as-a-Service (BaaS) providers

Licensed functions, are always routed to regulated providers. You have two options. You can either apply on your own and manage your upstream connections yourself or simply use Finxone’s managed services.

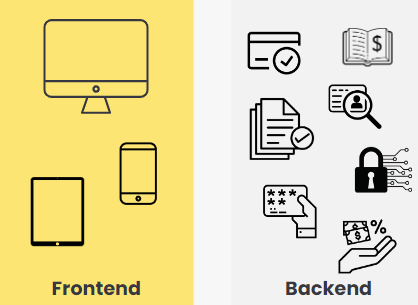

Easy Drag-Drop Frontend

The customer starts to create the Frontend app by simple drag and drop of widgets in the Finxone App Designer.

integration to BaaS

The Finxone takes care of the integration to BaaS providers and aggregators and other 3rd party providers. The Finxone Compliance Team will support the customer with their application to the BaaS provider.

Finxone Automatically builds Backend

The Creation of the Backend is automatically triggered by the customer when they build their frontend in the App Designer. Complex processes for which the backend needs to connect to 3rd Party Providers through APIs, such as payments, card management, user validation/ Know-Your-Customer (KYC), Transaction Monitoring, Information security, Ledger, Loyalty program, Loan application, and others, are configured and ready for when their application goes live. Our product is built with compliance in mind, so that the customer does not have to worry about it.

With Finxone, businesses can focus on building innovative applications and delivering value to their customers, while leaving the heavy lifting of connecting to BaaS providers to the platform

Finxone’s App Designer is a key feature that allows customers to easily create the Frontend of their application. With a simple drag and drop interface, customers can quickly and easily add widgets to their application, customising it to their specific needs. This process is user-friendly and requires no technical knowledge or coding experience, making it accessible to a wide range of users.

Once the Frontend is created, the coding of the Backend is automatically triggered when the customer drops a widget. This means that the customer does not need to worry about building the Backend from scratch, as the process is initiated by the creation of the Frontend. The Backend is configured to handle complex processes such as payments, card management, user validation/Know-Your-Customer (KYC), transaction monitoring, information security, ledger, loyalty programs, and loan applications. These processes are preconfigured, so they are ready to go when the customer’s application goes live.

The platform is built with compliance in mind, so customers can rest assured that their application will comply with all relevant regulations. This is particularly important in the financial industry, where compliance requirements can be complex and constantly changing. By building compliance into the platform, Finxone takes the burden off customers, allowing them to focus on building innovative applications that meet the needs of their customers.

Finxone also takes care of the integration to BaaS providers and aggregators, as well as other 3rd party providers (e.g. needed for identity checks, companies house checks, etc). This eliminates the need for customers to invest time and resources in building their own API gateways to connect to these providers. By handling this integration, Finxone saves customers time and resources, allowing them to focus on building and improving their applications, and creating the solutions their customer’s are looking for.

Finxone’s Compliance Team is available to support customers with their application to the BaaS provider. This ensures that the customer’s application meets all necessary compliance requirements, and that any issues that arise during the application process are quickly and effectively resolved. The team is knowledgeable about the financial industry’s complex regulations, making them a valuable resource for customers who want to ensure that their applications comply with all relevant requirements.

In addition to the ease of creating frontend and backend applications, Finxone offers another key benefit to its customers: the ability to bypass long queues and high thresholds for approvals and/or volumes in main BaaS providers. By connecting to multiple BaaS providers and aggregators, Finxone offers its customers the flexibility to choose the provider that best meets their needs, without being restricted by long wait times or high volume requirements. This means that businesses can quickly and easily begin using BaaS providers, regardless of their size or scale, and can benefit from the latest financial technology without being held back by lengthy approval processes.